Selecting the right insurance company can feel overwhelming – there are so many options and you want to make sure you’re working with someone that will be there for you when the unthinkable happens. While price and coverage are essential considerations, what about customer service? When you have a question or a claim, you want to be able to speak with someone that knows your situation and you’re not “just an account number.” Have you considered financial strength? You also want to be certain your insurance company can pay and settle your claim fairly.

The following are a few tips to help guide your decision and ensure you have a smooth experience protecting your family and assets.

Financial Strength

Financial ratings of insurance companies describe how financially stable they are, meaning their ability to meet ongoing insurance policy and contract obligations. There are five main ratings companies – A.M. Best, Fitch, Kroll Bond Rating Agency, Moody’s and Standard & Poor’s – and they consider a variety of criteria to determine financial health, including how well the business is doing financially, can it withstand increased claims and vulnerability to natural disasters. Every rating agency has its own methodology, so ratings may vary somewhat among insurers.

This rating information is important to be aware of when you’re seeking insurance coverage because in the instance of a claim, you want to know the insurance company will be able to pay. Wallace & Turner has worked with top-rated insurance companies such as Westfield Insurance and The Cincinnati Insurance Companies for decades and has a proven track record of financial stability.

Reputation

Hearing first-hand what customers’ experience with an insurance company has been can be one of the most helpful ways to determine credibility and responsiveness. People often focus on cost when purchasing a policy, but when it comes time to file a claim, they may regret not having considered feedback from current or past customers which provides insight into how the company operates.

An insurance company’s website can give you a good sense of their professionalism, but go beyond this in your research – look at Google reviews, Facebook reviews, LinkedIn testimonials and other online resources such as the Better Business Bureau. Also, your state insurance department can tell you if the company has had consumer complaints about its service.

However, keep in mind that people are often more likely to head online to rant about a one-time bad experience rather than spend time to post about a positive experience.

Customer Service

Insurance can be complex so it’s critical to work with a company that will spend time from the outset explaining your options and tailoring a policy that best fits your needs.

This is especially true if you ever have a claim and need timely assistance. Find out if the company has a designated customer care center or in-house claims department. Many companies offer 24-hour claims reporting and will even text with customers to ensure they are being helped in a timely manner. You don’t want to have an accident or loss and end up sitting on hold for hours or not receiving a call back for several days.

Digital Capabilities

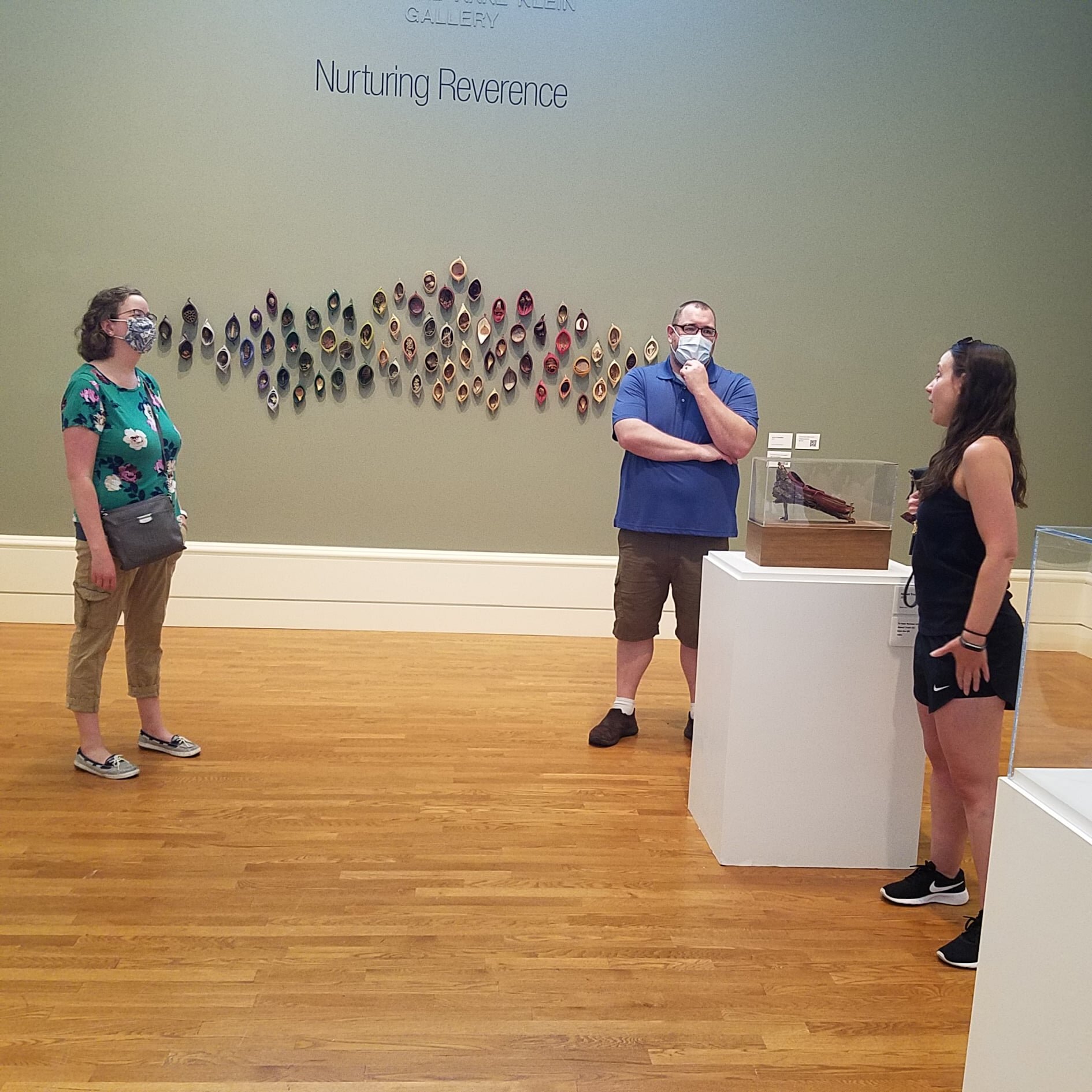

Rather than going in to your insurance company’s physical office, many would prefer to pay their bill or file a claim digitally. Also, in rare circumstances like the COVID pandemic, you want to know that your insurer can quickly pivot to continue serving you remotely.

Talk with the prospective insurance company about their options for paying bills online, managing your policy via an app, or even creating a digital home or business inventory. These are all benefits that can make your insurance experience seamless. Moreover, if you’re not as comfortable with technology, it’s equally important that your insurance company isn’t strictly online/digital and you have the opportunity to sit down face-to-face and ask questions or update your policy.

Expertise

Yes, cheap insurance is great for your wallet, but it doesn’t mean you have the right coverage for your needs – which becomes problematic come claims time. Unfortunately, many people look for a policy with a lower premium and they don’t realize this doesn’t cover them for a major accident. Rather than focusing on price alone, choose an insurance company that will take the time to help you understand coverage options and create a tailored policy.

Look at the company’s website and social profiles to see what their professional designations are and if they are providing educational resources to clients. This demonstrates their credibility and willingness to share their expertise.

To speak with a Wallace & Turner insurance agent in Springfield, Ohio or Urbana, Ohio, click here.

Expertly reviewed by Wallace & Turner Team Members

Wallace & Turner is an award-winning independent insurance agency with offices in Springfield, Ohio and Urbana, Ohio. Since 1870, we have worked with top-rated insurance companies to provide auto, home, business, life and health insurance.