Wallace & Turner is proud to support the Wild Baseball 10U team! Producer Ben Galbreath coaches and loves coaching his son, pictured second from the right-hand side. If your business would like to be a part of Wild Baseball send them a message: springfieldwild@gmail.com GO WILD!

Renters Insurance: Why You Need It & What’s Included

Myles Trempe - Producer

Consumers need to understand what their renters insurance policy covers and does not cover. Many assume that if something happens to the building, it’s the responsibility of the landlord to protect their property. This is generally not the case and the exact reason renters need personal coverage.

What Renters Insurance Covers

Renters insurance covers most specifically your personal property (your belongings) and your personal liability. Consumers should take inventory of their belongings to determine the total value if a loss took everything. Talk with an insurance agent who can explain if those contents are covered on replacement cost or actual cash value. Actual cash value policies are generally less expensive, but your personal property is depreciated, therefore, leaving you unable to replace some items.

Renters Personal Liability Exposures

Be aware of your personal liability exposures and talk with your agent regarding which limit of liability should be on the policy. Many policies have exclusions to personal liability as well; review those exclusions with your agent to make certain you have coverage if the claim arises. For example, certain dog breeds are excluded for liability if a dog bite occurs. If you have a dog or plan to purchase one for your apartment, make that call to your agent.

What’s Excluded in a Renters Policy

Renters should also be aware of what is excluded in the policy. Floods and earthquakes are not covered by renters insurance. Depending on where you live, these are two coverages that you may want to have, even though they are an additional cost.

Why Talking to a Local Insurance Agent is Important

A first-time buyer, unless well-versed in renters insurance, should have an agent or broker explain the complexities of a policy, rather than using an online quoting tool. These tools are only as good as the information provided and often don't provide a complete quote for coverage that will actually be needed. This would leave many renters underinsured in the event of a loss.

It’s best to talk with an insurance agent who can help advise on policy language, coverage offerings, exclusions and financial information pertaining to the insurance company they may be working with. Most renters insurance policies offer similar coverages, and an agent can speak on firsthand knowledge of which coverages may best fit the consumer’s situation and budget.

Questions about renters insurance? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

Wallace & Turner Returns as Sponsor for Happy Half Marathon 2021

Wallace & Turner is thrilled to once again sponsor the Happy Half Marathon on August 14, 2021 in Springfield, Ohio at a brand new course that starts and ends in historic Downtown Springfield. We hope to defend our victory as 2019 Water Table Competition Champions!

The idea for the Happy Half comes from family members running the 13.1 mile course from Springfield to Yellow Springs to train for a full-marathon in which they would be raising money to help cover the cost of cancer treatment for Mike Maloney, father of Co-Director Alex Maloney. The first official Happy Half Marathon was held in 2012. The race brings together runners from all over to support the cause and gives them a chance to achieve their fitness goals. Proceeds benefit Mercy Health Springfield Cancer Center.

Homeowners Insurance vs. Renters Insurance — Which Coverage is Needed

Myles Trempe - Producer

Homeowners insurance and rental insurance have a similar responsibility of covering the physical structure and other structures on the property. A homeowner’s policy will provide coverage for personal property (contents) and personal liability for the household members. Typically, rental insurance will not provide personal property coverage as that would be the responsibility of the tenant. Additionally, liability coverage on a rental policy would only provide protection for that specific location. For example, if a tenant gets hurt and the landlord is found legally responsible, the liability coverage would protect the landlord against medical expenses and legal costs. An insurance agent can help explain what types of scenarios may and may not be covered by homeowners insurance while you're renting your home to tenants and why you may need to purchase rental insurance.

Producer Myles Trempe addresses common questions about homeowners insurance and renters insurance below.

Which type of coverage is needed if you simply plan to rent out a spare room in your home?

If a homeowner rents out a portion of their home or even a spare room, they should contact their local insurance agent to better understand how their homeowner’s policy will respond. Some insurance companies may allow for a short-term rental situation assuming they have been made aware by the agent or insured. Most likely, the company is going to require the insured to move the risk to a commercial policy or rental dwelling policy as it would constitute as a business. Standard homeowners’ policies do not provide any coverage for business activities conducted in the home.

Do you ever need both homeowners insurance and landlord insurance?

Yes, this is a very common scenario if you own a home and additionally own rental dwellings. Your primary residence that is not rented should have a homeowner’s policy in place that will provide personal liability, personal property coverage and building coverage. If you have a portfolio of properties that are rented, those should be insured on a rental property policy or what is called a DP3 policy. A landlord should have a DP3 policy for all rentals as it will provide coverages specific to his investment, specifically “loss of rents” which will allow the landlord to recover loss rent while the house is being restored due to a covered peril of loss.

What is the typical cost for landlord insurance versus homeowners insurance?

A standard homeowner’s policy is more comprehensive than a DP3 policy but in turn actually costs less than a DP3 rental policy. A homeowner’s policy as mentioned will not provide coverage for the person purchasing a home to rent to others. The transaction of you renting out the home is an increased risk exposure in the eyes of an underwriter with an insurance company. As we examine our book of business and compare homeowner and rental polices with similar rebuild costs, the premiums are anywhere between 20-30% higher for rentals.

What factors can influence how much you pay in premiums for either type of insurance?

Many factors can impact the cost of homeowners and/or rental insurance. Underwriters examine prior losses, conditional factors of the risk, location, cost to rebuild, credit score and deductible limits, just to name a few.

What are some coverage additions worth evaluating when it comes to landlord insurance?

A landlord will want to work with a local insurance agent to better understand which coverages will best protect them and their investments. Depending on the cost of each investment and the requirements, they may have their bank (if a loan is applicable) decide to insure the property for replacement cost, actual cash value, agreed value or functional replacement cost. A rental property should have liability coverage which will protect from the legal and medical costs associated with someone being injured on the rental property. An agent should also provide an umbrella quote if the limits of coverage may not be sufficient to cover potential liabilities. Rental properties should be covered for loss of rents which will provide protection for lost rent payments due to the property being uninhabitable due to a covered peril of loss. A local insurance agent will have a better understanding of the risk exposures due to the geographic location of the risk. An agent may recommend flood or earthquake coverage as those are excluded from a standard home or renal dwelling policy.

To what extent an umbrella policy is needed or recommended when you have landlord insurance?

Umbrella insurance covers you and members of your household against lawsuits involving personal injury to others, damage to other people’s property and a variety of claims such as defamation, landlord liability and false imprisonment, depending on your policy. A local agent will help navigate your underlying liability limits to better recommend if an umbrella is necessary. Being a landlord or property owner comes with serious risk exposures. I always recommend an umbrella policy as the underlying limits of a policy may not be sufficient.

What are the steps involved in transitioning from homeowners insurance to landlord insurance?

This transition must occur if the home becomes rented permanently and is a source of income. If you purchase a property to be rented to others, you will need to notify your insurance agent to secure a rental policy.

Is it worth it to get landlord insurance?

Absolutely. Whether you own a home or a rental property, it is essential to have liability coverage. As for insuring the building for physical loss, that is a decision the investor would need to make. If a property has a loan, the bank will require property insurance.

Which types of carriers offer the best renters insurance coverage?

A local, independent agent will help you navigate home and rental insurance. Their expertise of the marketplace will allow the property owner to make a sound decision for the best coverage options provided by the best carriers. The independent agent works very closely with their insurance companies to best understand their products and how those offerings best support their clients.

Questions about homeowners insurance or renters insurance? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

Motorcycle Insurance Is a Must-Have – Ben Galbreath Discusses Factors That Play Into the Cost of Coverage with NextAdvisor

As a motorcyclist, several things may come to mind when you jump on your bike – helmet, leathers, boots, gas, tires – but insurance coverage may not be among them. It should be.

“Insurance is an absolute when it comes to motorcycles,” Producer Ben Galbreath told NextAdvisor. “I recommend the maximum medical payment amount and advise clients to at least match their auto insurance bodily injury and uninsured/underinsured motorist coverage.”

It’s required for motorcycle riders in most states to buy liability coverage, as that type of insurance compensates others for injuries and damages should you cause an accident. Outside of your state’s minimum requirements, motorcycle insurance coverage can be as broad or as small as you would like it.

“The hurdles you might run into is each insurance company underwrites motorcycle coverage differently,” commented Ben. “They restrict certain coverages to a maximum they will make available, i.e. medical payment, liability coverage, or even possibly deductibles.”

Galbreath said riders should also consider coverage for people who ride with them, which is also known as guest passenger liability coverage. The coverage that comes into play is medical payments, and possibly bodily injury and or uninsured/underinsured motorist coverage, depending on your state and insurer. Some insurers automatically include guest passenger liability coverage in their policies, and some sell it as a separate add-on.

Read the full article here.

Questions about motorcycle insurance? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

Should You Redo Your Healthcare Plan? Colleen Corrigan Weighs in on the Pros & Cons With GOBankingRates

The wave of job losses caused by the pandemic have disrupted many people’s incomes and insurance arrangements. Beginning in February 2021, President Biden opened a Special Enrollment Period through healthcare.gov for consumers, giving enrollees additional time to re-evaluate coverage needs with expanded tax credits or subsidies which help to reduce monthly premiums.

In an interview with GOBankingRates.com, Life & Health Agent Colleen Corrigan said if you enroll in a new healthcare plan through your employer or through Marketplace, you may be able to save money. On plans purchased through the U.S. government healthcare exchange website, Colleen commented, “Most people who do not have access to health insurance will qualify for a subsidy. The Centers for Medicaid & Medicare Services says on average, one out of four enrollees in Marketplace coverage will be able to upgrade to a higher plan category that offers better out-of-pocket costs at the same or lower premium compared to what they are paying today.”

It pays to shop around for insurance coverage if you’re interested in getting the best coverage for the best price. Colleen added, “Many shoppers whose income is too high to qualify for a subsidy may be better off with health plans sold directly by insurance companies. These plans will not be listed on Healthcare.gov. A trusted broker can help you navigate these options. However, once a consumer begins shopping for plans outside of Healthcare.gov/Marketplace, the plans are not held to the same standards as the plans offered through the Affordable Care Act/Marketplace rules. These premiums are often lower in cost but will not include minimum essential coverage such as preventive care or pre-existing conditions.”

Read the full article here.

Questions about health insurance coverage? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

What Small Businesses Should Know About Accidental Death & Dismemberment Insurance

Ben Galbreath - Producer

Accidental death and dismemberment insurance is insurance coverage similar to that of life insurance, and is commonly used as a supplement to a life insurance policy. It covers an employee in the event of an accidental death, or an unforeseen accident that results in the loss or function of a body part (e.g., arms, legs, eyesight, speech, hearing). AD&D does not cover deaths caused by existing medical conditions.

Producer Ben Galbreath discusses what small businesses should know about accidental death & dismemberment insurance:

What is accidental death and dismemberment insurance (AD&D)?

Accidental Death & Dismemberment insurance is a good coverage to be added to a benefits portfolio. This coverage is on a very limited form, meaning it will only pay a benefit due to an accident. Definition of an “accident” is an unforeseen incident that happens unexpectedly and unintentionally. The coverage is triggered only by an accident.

Do you have to offer AD&D to employees?

AD&D is an optional benefit that can be added to an employer’s benefit portfolio. If the benefit is offered to one employee, it will need to be offered to all. The employees will have the option to take the coverage or not. An employer does not have to offer the AD&D if they don’t want to. If health coverage is offered, AD&D is usually a rider included on the coverage. It can also be offered individually.

How does offering AD&D to employees benefit employers?

Employers offering AD&D benefits is a way of broadening health benefits to make their business more attractive to prospective employees. With the growing struggle to recruit and retain quality employees, this could attract those employees.

How does being offered AD&D benefit employees?

The coverage benefits employees to some extent – if an employee has an accidental dismemberment, it would help with the medical bills and rehabilitation. In terms of accidental death, the death benefit would be paid out to the employee’s family.

What does AD&D cover?

AD&D is only triggered in the event of an accident, meaning unintentional death or dismemberment of the insured. Death is self-explanatory and the death benefit would be paid out. When it comes to dismemberment coverage, this would apply to loss, or the loss of use, of body parts or functions (e.g., limbs, speech, eyesight, hearing).

Anything else a small business owner should know about AD&D?

AD&D is usually added to a group health policy for a very minimal cost, but it can also be offered as standalone coverage. Additionally, AD&D can be added to a life policy or group life policy.

Small business owners need to be very careful when offering this coverage due to its limited coverage for unlikely events. It is supplemental life insurance and not an acceptable replacement for term or whole life insurance. This is why it’s usually added to group health or life coverage.

Generally speaking, I don’t advise small business owners to offer AD&D coverage on its own. This type of coverage can be offered in a better supplemental benefit programs. Many accident policies, critical illness and others, offer similar coverage. The best advice would be to speak with a supplemental benefits provider to understand the different options that are available. Working with an independent broker can help build a strong benefits package that could be more cost effective for the employer and employee.

Questions about AD&D insurance, or group health or life coverage? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

Wallace & Turner Co-Hosts Food Truck Thursday with Real Estate II

Wallace & Turner partnered with Real Estate II to kick off the first Food Truck Thursday of 2021, held on April 8th. The community gathered for tasty food from Rudy’s Smokehouse and a celebration with Real Estate II to announce their new ownership and partners, Lisa Smedley, Ryan King, Lori and Al Fulk.

Producer Ben Galbreath spoke about WT and Real Estate II’s recent sponsorship of the Clark County Solid Waste District Adopt-A-Drop location at 525 East Home Road in Springfield. The “Operation Adopt-A-Drop” program invites residents or groups to become stewards of the county’s recycling sites, and is aimed at creating a pleasant recycling experience by having volunteers clean up those sites.

Donations were collected at Food Truck Thursday in support of Keep Clark County Beautiful.

View the Real Estate II ribbon-cutting ceremony here.

Factors That Impact Your Home Insurance Rate – P.J. Miller Interviewed by Bankrate

P.J. Miller - Partner

Homeowners insurance premiums vary from state to state in the U.S., so what impacts the rates? Partner P.J. Miller spoke with Bankrate to examine the various factors that determine home insurance premiums.

Credit history

Like bank lenders, many insurers check homeowners’ credit in assessing the level of risk they are taking on.

“Most insurance carriers use credit as a portion of the rate-setting process in states where it is permitted,” said P.J. “While it is supposed to be a ‘portion’ of the rate calculation, most believe it plays a significant role in determining the price for homeowners insurance.”

Claims history

Insurance companies often base decisions on patterns of behavior. When a homeowner files a claim, the homeowners insurance company assumes that he or she is more likely to file additional claims in the future.

P.J. went on to explain how the type and number of claims you make could influence rates. “Even if claims were made in a previous home, this history will follow you,” he said.

Age of home

If you live in an older home or one that would likely need a lot of improvements if rebuilt, you will likely pay a higher home insurance premium.

P.J. explained that age and location are important factors in determining the cost to rebuild a home. “Insurers will assess the difficulty to replace or repair your home to determine rates,” Miller said. He added that home improvements such as roof replacement, upgrades to your electrical, heating or plumbing system and the installation of a security system “can all positively impact your rate as the likelihood of a loss declines.”

P.J. noted that your insurance agent should be notified of any upgrades to your home.

Deductible

A homeowners insurance deductible sets the amount that you will pay out of pocket. Agreeing to a higher deductible will decrease your premium, but it could also cost you more in the event of a claim.

“Many insurers also offer disappearing deductibles, which means they reduce your deductible if you don’t have any claims over a certain time period,” P.J. said.

The above are just a few of the factors that may be considered in your homeowners insurance. Click here to read the full article and learn more.

Questions about homeowners insurance coverage? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

Working From Home? Check Your Insurance Policy

It’s often said that purchasing a home is the biggest investment that one will make in their lives. Many homeowners (smartly) choose to protect that investment with home insurance. And now that COVID-19 has swept the globe, you may be using your home as an office space, as well.

Did you know that working from home may affect your insurance policy? You may be:

Working from home temporarily due to COVID-19

Running a new business out of your house

Self-employed

Depending on your situation, you may require a different policy. Here are a few variables that could impact your coverage:

You May Not Be Covered for Damages

Before the pandemic, you may not have had expensive computer equipment in your home. As such, your insurance policy might not offer coverage for these additional electronics. Most policies have a limit for the amount that they’ll cover, and the computer and related accessories that you purchased for work may exceed it.

In some circumstances, your employer may have provided you with a work computer to take home. Their commercial insurance policy should cover any damages to the equipment, so you might not need to worry if any damage occurs. However, it’s best to check with your employer to determine if this is the case.

What About Liability?

Before the pandemic, your house was your personal residence, and that was it. Now, it’s also a place of business.

Although many of us are reducing social contact to prevent the spread of the virus, you may need to receive visitors in your home for a business-related reason. Client meetings may require face-to-face interaction. But if any damages are incurred by the guest during their visit (like a slip on an icy doorstep or bite from a dog), you may be held liable to cover them.

When you registered for home insurance, you may never have anticipated that one day, you’d be working from home. It’s important to review what types of claims your policy actually covers.

No one wants to be held liable for a claim that they believed they had coverage for. Ask your insurance provider about liability insurance for these situations.

Have You Considered Home-Based Business Insurance?

Many people’s employment statuses have changed since the start of the pandemic. You may have decided to start your own business rather than work for a company. This is a bit different than working from home temporarily. For this arrangement, you’ll need a home business insurance policy that covers home-based business assets and expenses.

Think about some of the business equipment that you’ll store in your home, which varies depending on your industry. You may have items like:

Power tools

A computer, printer or other office supplies

Inventory such as clothing and apparel

The costs of replacing these items will add up. If they were to be damaged in any way, not only would it cost you to replace them, but it would impede the daily operations of your company. A standard home insurance policy won’t cover expenses that are related to a business. You may need to extend your coverage to include business assets.

Business Interruption Insurance

This policy is relevant to those working out of their home. If your office is damaged in a fire or other natural disaster, you won’t be able to carry out business as usual. With business interruption insurance, you will be covered for replacing damaged equipment or losses in revenue.

When you’re just starting a business, a setback can be devastating. Talk with your independent insurance agent about business interruption insurance.

Pro Tip: Get a Handle on Rising Electricity Costs

If you’ve been working at home for a year, you may have noticed that your energy bill has steadily increased. Instead of spending 40 hours a week out of the house, you now spend that time using your home office.

We have a few energy saving tips for when you’re at home that will bring down electricity costs:

Use a drying rack or clothesline instead of your dryer

Set up power bars and turn off unused electronics

Replace any incandescent bulbs with LEDs

When you lower your energy bills, you can use those savings to pay for more comprehensive homeowners insurance.

The bottom line is that every homeowners insurance policy is different. In all likelihood, you will need to expand your coverage to properly maintain your home office. When you’re working from home, be sure to inform your insurance agent and ask if any additional coverage is required.

Questions about home business insurance coverage? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

Wallace & Turner Sponsors New Carlisle Farmers Market

Wallace & Turner is serving as a Leadership Sponsor for the New Carlisle Farmers Market throughout the summer and into the fall to help provide the community with local healthy foods, baked goods, arts, and crafts. The Farmers Market will be open Saturdays from 10am to 2pm, beginning June 19 thru October 16.

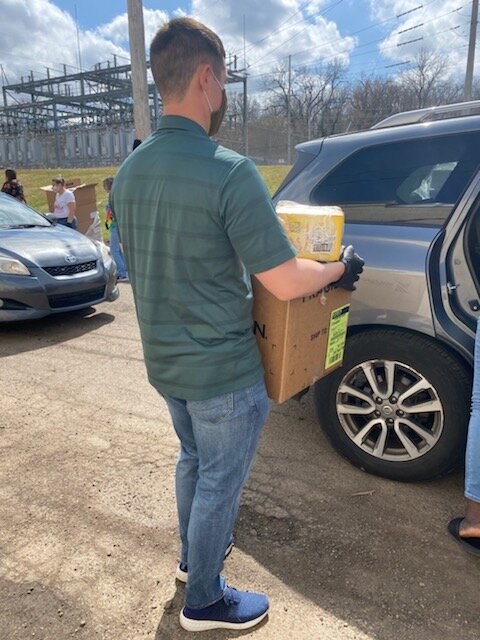

Combating Hunger in Our Communities — Wallace & Turner Volunteers with Second Harvest Foodbank of Clark, Champaign, & Logan Counties

In an effort to combat hunger in our surrounding communities, Operations Manager & Commercial Lines Account Manager, Lisa Miller, and Commercial Lines Analyst/Accounting Assistant, Zach Vaughn, volunteered with Second Harvest Food Bank of Clark, Champaign & Logan Counties. The mission of the Ohio Tri County Food Alliance/Second Harvest Food bank is to alleviate hunger in Clark, Champaign, and Logan Counties by sourcing and distributing nutritious food to people in need, building community partnerships, and mobilizing the public to support hunger relief. Learn more: https://www.theshfb.org

Operation Adopt-A-Drop: Wallace & Turner Adopts Recycling Site in Springfield

The Clark County Solid Waste District introduced a new program “Operation Adopt-A-Drop” to improve the recycling experience for residents. The program invites residents or groups to become stewards of the county’s recycling sites, and is aimed at creating a pleasant recycling experience by having volunteers clean up those sites. Residents or groups that decide to adopt a recycling site are expected to clean-up their adopted site at least once a month.

Wallace & Turner has adopted the 525 East Home Road location in Springfield. Additional recycling locations can be found at 1620 West Main St. in Springfield, 5467 Selma Pike in Green Twp., 1539 Student Ave. in Northridge, 7952 Dayton-Springfield Road in Mad River Twp., and at the corner of Old Columbus Road and State Route 54 in Pleasant Twp.

Learn more about Operation Adopt-A-Drop here.

How to File a Home Insurance Claim – Ben Galbreath Interviewed by Insurance.com

Many homeowners have questions about what's involved with the homeowners insurance claims process: How do home insurance claims work? How are homeowners insurance claims paid? And how long do homeowners insurance claims stay on your record? Producer Ben Galbreath addressed home insurance claim topics in an interview with Insurance.com.

Can you keep your home insurance claims money?

Technically, if you are paid for a claim by your insurance company, you aren't required to spend the money on repairs, remediation or replacement if you own your home outright. But if you pay a mortgage, your lender may require you to use the money to fix or rebuild your home.

Even if you own your home outright or your lender doesn't obligate you to use the claim payout for repairs, think twice before choosing to pocket the money.

"Say you choose to take the claims money, not repair the damage and instead buy a car, for example. If so, your insurance company has every right to amend your policy, exclude damaged property they've already paid out for or even cancel or non-renew the policy altogether. If you do elect to keep the funds and not make repairs, the replacement cost clause becomes null and void," cautioned Ben. "When you sign the application for a standard homeowners insurance policy, you are agreeing to transfer the risk of financial loss to repair or replace any damage to your home and put it back to its original status before the loss or better."

How long does a home insurance claim stay on your record?

Typically, an insurance claim related to a recorded loss remains on your record for three to seven years. If you file one or more claims within this period, your premiums may increase or you could be excluded from coverage.

"Insurance companies tend to look at the frequency and severity of claims. If there is a high frequency - meaning high number of claims - they may increase your deductible, force you to purchase specific coverage elsewhere, change the way losses are evaluated from replacement cost to actual cash value, or cancel your policy entirely," Ben said.

Read the full article here.

Questions about boat or watercraft insurance coverage? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

What to Know About Boat Insurance – Ben Galbreath Provides Insight to The Family Handyman

If your boat has a motor, it probably needs boat insurance. In an interview with The Family Handyman, Producer Ben Galbreath explained what you need to know about boat insurance, including how much it costs to cover damages, loss and liability.

Do you need boat insurance?

If you have any kind of motorized watercraft, whether it’s a small fishing boat or an expensive ocean-going vessel, you almost certainly need boat insurance.

“If it has a motor, you need to consider at least liability coverage. The larger the motor, the more risk you will take on legally,” Ben said. “If you are financing a new boat, your lender will require that it be insured.”

Ben noted that if the boat is stored in a marina or other privately owned location, the owners will almost certainly require the boat be insured.

And while non-motorized boats such as canoes and kayaks usually don’t require an insurance policy, Galbreath added, they should at least be added to an existing homeowner’s policy. That’s especially true if you keep the boat at a cabin or holiday home. “If you are loaning out the canoe or kayak to someone,” he says, “you’ll need liability coverage, at a minimum.”

How does boat insurance protect you?

Standard options typically include: physical damage, liability, personal property, towing and assistance, and theft.

Two areas that may or may not be covered, but are definitely worth asking about:

Uninsured boater. “If you get hit by another boater that doesn’t have enough insurance or any insurance,” said Ben, “uninsured boater coverage will kick in to pay for damage or injuries.”

Hurricane coverage. If you live in the eastern/southeastern U.S. or anywhere with the possibility of hurricanes, ask if your boat is covered for storm-related loss or damage.

Types of boat insurance

Damage reimbursement and liability are two sides of the same coin with boat insurance. Ben said liability requirements depend on state laws, as well as lender requirements if you have a mortgage or loan on the boat.

“Another variable for coverage,” he commented, “is if the boat will be out on a private lake, on a state lake or reservoir, a river or tributary, or on open water or the ocean.” The greater the risks of adverse weather, theft or unfortunate encounters with other boaters, the more detailed the policy will be.

Average Cost Ranges of Boat Insurance

Boat insurance premiums range from low to costly, Ben commented, and some small motorboats may be endorsed (added) onto an existing homeowner’s policy for little extra cost. However, he said there are limits in the policy for the boat’s length, motor horsepower and maximum speed. “You should consider separate coverage if you have a large, fast boat,” he says. “And the faster and larger you go, the higher the cost.”

Read the full article here.

Questions about boat or watercraft insurance coverage? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

The Open Annual Leadership Clark County Golf Outing – Wallace & Turner Serves as Sponsor

One of the first local golf outings of the year, the Leadership Clark County event brings together past graduates, community leaders and other supporters to raise money over a round of golf for the nonprofit. Wallace & Turner is serving as a hole and team sponsor.

The event will be held on Friday, May 7, 2021 at Windy Knoll Golf Club. Contests include longest putt, longest drive, closest to the pin and the orange ball competition.

How to Protect Your Home from Spring Flooding

It’s finally springtime, and you’ve just woken up to the sound of chirping songbirds. The sun streams through your window and you can breathe a sigh of relief that winter is over. You couldn’t be happier—until you walk downstairs and notice that your basement has become a swimming pool.

Spring floods can mean bad news for your home. They’re often the cause of mold growth, structural weaknesses and extensive water damage to your belongings. Even if you’ve got the proper home insurance coverage and flood insurance protection, it’s still a huge hassle to remedy.

If your home has flooded in the past, it’s more at risk for a flood in the future. You’ll need to take extra precautions. Make sure that your spring cleaning doesn’t involve a watery mess by protecting your home with these tips:

Inspect the Foundation

Water will find any cracks or gaps in your home and quickly pour inside. It will turn your brand new laminate floors into a soggy mess. For this step, you may want to contact a home inspector. They can survey your property and find any weaknesses in the structure of your house.

Cracks in your home’s foundation can be dangerous. Along with causing floods, they can allow insects and radon gas to seep into your home. If you spot a crack, you can patch it up using grout or concrete, depending on the size of it.

Upgrade Your Sump Pump

When your home floods, it often starts in the basement. That’s why these rooms have sump pumps, a mechanism designed to prevent water overflows.

A sump pump redirects water away from your home, which keeps your basement dry. Prevent water in your home by installing and maintaining a sump pump. It may be worth installing a back-up battery, as well, so that the sump pump will still function during a storm.

Check on the sump pump annually to ensure it’s in working order. If you’re handy, you can inspect it yourself. Even so, you may want to call a plumber to do the job, just to be safe.

A sewage backup is one of the worst issues that can happen to a homeowner. A backflow valve can provide your home with added protection against floods; it ensures that the water doesn’t flow into your home if there’s a backup.

Invest in Flood Insurance

When you’re choosing an insurance policy, talk to your independent insurance agent about what it offers for flood protection. Not all standard plans offer coverage for this type of incident. Flood protection plans can grant you peace of mind that you will be insured if there is a disaster.

Even though home insurance is another monthly expense, it will pay for itself in the event of a flood, fire or theft.

Clean your Gutters

We hardly think about our eavestroughs, but they play an important role in protecting our homes against water damage.

However, they’re not very effective at redirecting water if they’re clogged with leaves, twigs and other debris. Schedule an eavestroughs cleaning so that your gutters can handle the wetness that’s on its way.

You should also check where the downspouts are redirecting water. Make sure that it falls at least several feet away from your home.

Check your Window Wells

If you have windows in your basement, you know they aren’t as strong as a standard wall. To protect them from groundwater, window wells are usually installed. However, these wells can become built up with debris over time, diminishing their effectiveness.

Give any window wells on your home a thorough cleaning. If they’re blocked, water will collect near them and eventually seep into your home.

Inspect Your Roofing System and Plumbing

A small leak in your roof or pipes will result in a torrential downpour the next time it rains. Maintaining a healthy pipe and roof system is one of the most effective ways to prevent an indoor flood.

If you suspect that your roof is leaking, call a contractor who’s experienced with that type of roof. Similarly, contact a trusted local plumber to have a look at your home’s pipes. Detecting these issues early can save you a major headache (and repair bill) down the line.

We know what you’re thinking: the cost of preventative maintenance really adds up! It might be expensive to fix these issues with your home, but once you consider the cost of water damage, the upgrades pay for themselves.

April showers don’t need to come with a flooded basement. Make these preventive measures a part of routine maintenance for your home.

Questions about homeowners and flood insurance coverage? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

When to Update Your Homeowners Insurance

Being a homeowner comes with great responsibility. You are responsible for the property itself, your family who lives in the house, and your personal belongings. That is why having a comprehensive homeowners insurance policy is essential. It gives you the protection needed in case you face a loss and financial difficulties.

As life is full of unexpected circumstances, be sure to update your policy accordingly to protect your property from weather, non-weather, and accidental incidents. If you are wondering when to update your homeowners insurance, read about some of the changes that will affect your policy below. These life events may impact any future claims, so pay attention to the terms and conditions.

Buying a new home

If you currently own a home and are buying a new one, unfortunately, you can't just transfer the policy. Your new home will likely have different risks and needs, which means you need different coverage.

If you’re setting out to buy your first home, know that homeowners insurance will protect your property, people, and the belongings inside from incidents that include, but are not limited to:

Storms, wind, lightning

Fire

Freezing, weight of ice and snow

Theft, vandalism

Riots

Aircraft and vehicles

Water from plumbing

Heating and cooling system tearing

Usually, this type of insurance is renewed once a year or when you have new coverage needs. The cost will depend on many things, but know that prices vary based on many factors such as square footage and additional structures such as an “accessory dwelling unit” (ADU), or the materials used to build the home. Therefore, it is best to consult with your agent, who has the expertise and the know-how to answer all of your questions and ensure you have proper coverage.

Your family is growing

If you are expecting a new member of the family, you should be thinking of updating your homeowners policy. You might wonder what the relation between your new baby and insurance coverage on your house is. One aspect of homeowners insurance is content coverage, and with a new baby comes a lot of new “stuff” – furniture, electronics, strollers, etc. You want to be sure these purchases don’t put you over your current coverage limits. Contact your insurance agent to discuss your current policy and if it needs to be updated. It’s also helpful to keep a running home inventory in the instance of a loss; this will make the claims process much easier.

Your family may also be growing with the addition of a four-legged member. Let your insurance agent know about this immediately, as potential claims such as a dog bite will not be covered if the dog is not listed.

Working on a home improvement project

You might decide to update your bathroom or remodel your kitchen. When you finish your home improvement project, be sure to let your insurance agent know. These additions and improvements to your property will affect your insurance policy. In the case of making a claim, you will need additional coverage for the upgrade costs.

If your kitchen remodel or the bathroom upgrade is making your home inadequate for living, you may think about staying with friends or relatives. During construction, you can even relocate to an apartment if your budget allows you to. In this case, you would also want to protect your property during relocation, especially if you own items of value. That way, you will have complete coverage and, most importantly, peace of mind.

You are going to retire soon

If you plan to retire and will likely be spending more time at home, you may be eligible for insurance discounts. There will be a reduced chance of theft since you are home, and accidental incidents like a fire will be less likely to occur.

If you have plans to travel now that you are retired, you should also check if it will impact your homeowners insurance. Suppose you travel for extended periods, the house will be empty, so you might need extra coverage. Even if you don't leave your home vacant but rather rent it to someone, you should talk policy updates with your agent.

Check if there is something your policy does not cover

Even with the adjustments and updates to your homeowners policy, it will not cover certain liabilities. Standard homeowners insurance does not cover flooding. You can purchase insurance covering flooding from heavy rain, snow, or hurricanes as a supplement to your homeowners insurance. As flooding is one of the most common natural disasters, it's advisable to consider purchasing this type of insurance as well. If you live in an area where the chances of heavy rain or snow floods are more significant than average, don't hesitate to talk this over with your independent insurance agent. Your agent will simplify the complexity of this insurance and any additional policies you might want or need. No one knows what the future brings, but one thing is for sure, you want your property and your family to be secure and your financial prospects intact.

Questions about homeowners insurance coverage? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.

Wallace & Turner Sponsors Junior Achievement Superhero Bowl-A-Thon

In support of Junior Achievement’s mission to inspire and prepare young people to succeed, Wallace & Turner sponsored the Mad River Region’s superhero themed Bowl-A-Thon on February 27 at Victory Lanes. With the bowlers and sponsors, we were able to raise more than $42,000 to support Junior Achievement programs in our region! WT was also recognized with the Best Costumes award!

Junior Achievement’s proven lessons in financial literacy, work and career readiness, and entrepreneurship are shown to positively impact the lives of young people. These lessons align with national and state educational standards and are delivered to millions of students across the country with the help of our education partners and volunteers from the local community. Research shows that JA Alumni are more likely to have a college degree, feel confident managing money, have career success, and have started a business as an adult.

Roadside Assistance Plans: P.J. Miller Interviewed by NextAdvisor on What You Should Know Before You Get One

Roadside assistance is one of those things that’s easy not to think about — until you’re stuck on the side of the road somewhere or your car won’t start. It’s different from your car insurance coverage because it provides relief for a temporary situation when your car is undrivable. It is usually much less expensive than your annual auto insurance premiums, or possibly without any additional cost to you.

If you drive a newer car, review the manufacturer’s roadside assistance plan first, since it’s likely included at no additional cost. “Check what benefits your new car includes, then compare to others,” commented partner P.J. Miller.

Additionally, most insurance carriers offer or include roadside assistance plans with your auto insurance coverage. But don’t assume your roadside assistance plan is tied to a large network of service providers simply because you receive it through your insurance carrier. Some carriers use the reimbursement model, which means you’d have to pay out of pocket if the need arises.

Continue reading the full article to learn more about roadside assistance plan options.

Questions about roadside assistance plans and car insurance coverage? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.