Wallace & Turner, Inc., Springfield and Urbana, Ohio’s largest, locally owned independent insurance agency, announced that Otto Larson has joined as a Partner/Producer. Larson brings over two decades of experience in the insurance industry and will work with both commercial and personal lines clients at Wallace & Turner. He was previously a Business Insurance Consultant and Market President with Marsh & McLennan Agency in the Midwest Region.

“We are thrilled to have someone with Otto’s breadth and depth of experience join Wallace & Turner,” commented President Patrick Field. “His insurance expertise and tenacity combined with local area knowledge will be a tremendous asset to our agency and clients. We know he will also be a great mentor to the next generation of agents as we continue to grow.”

“I am honored to join Wallace & Turner and be part of an organization with a rich history of serving their customers and communities for over 150 years,” said Larson. “The agency has an outstanding reputation for excellence in service and financial stability, and leads with a client centered approach, which was important to me when deciding to make a change. I look forward to getting to know our customers and helping them navigate the insurance marketplace while protecting their assets and future.”

Larson obtained a B.S. from Bowling Green State University and earned a Certified Insurance Counselor degree from the National Alliance of Insurance Education and Research. He is an active community member serving on various boards and as a volunteer, including Mental Health Foundation, Springfield Arts Council, Springfield Country Club, Ohio Means Jobs and the Red Cross, and co-chaired The Art Ball and Emerald Evening with his wife, Therese. He is also a graduate and served on the board of Leadership Clark County. Otto is currently a member of the Springfield Rotary Club, which serves children and adults with disabilities.

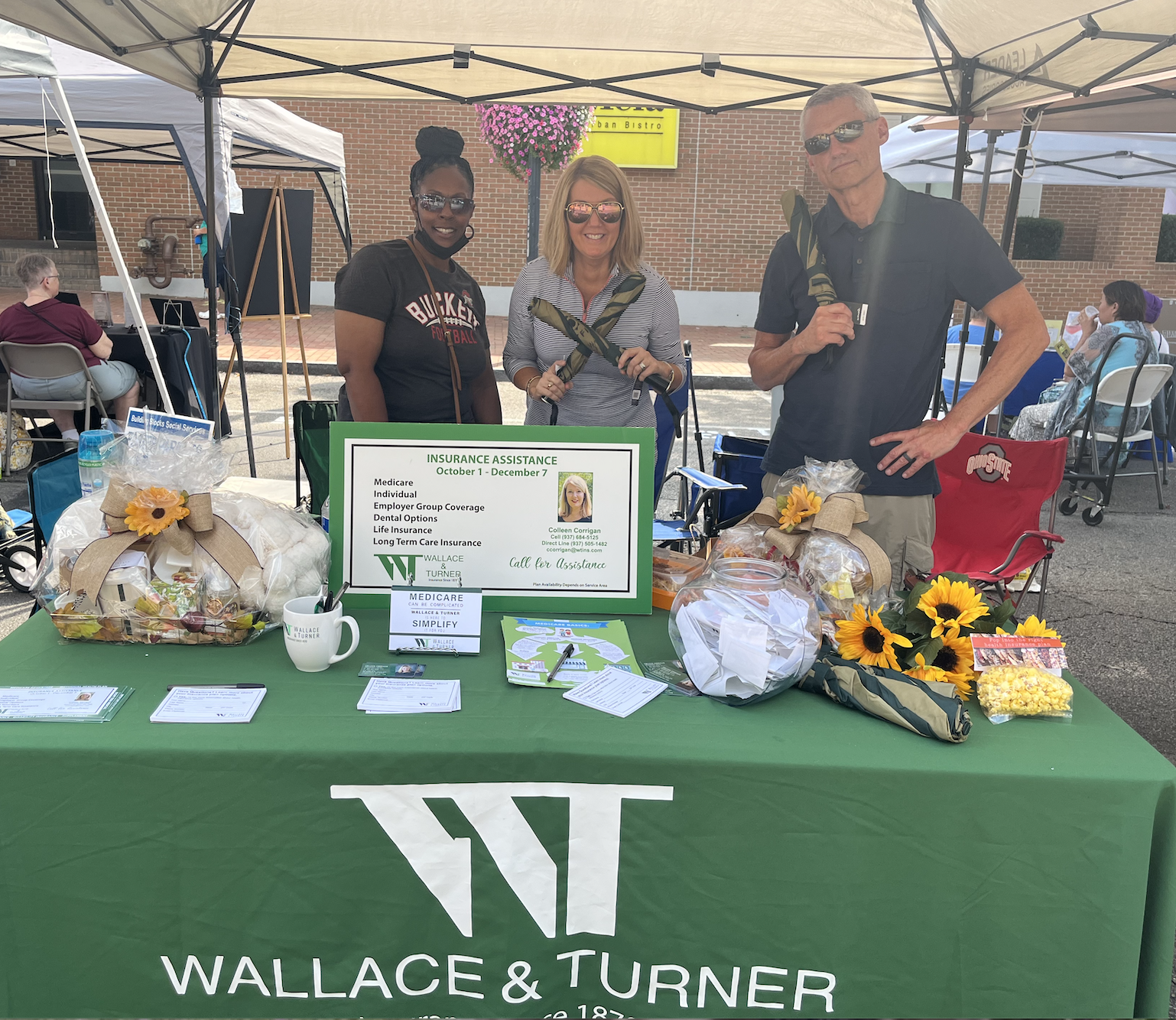

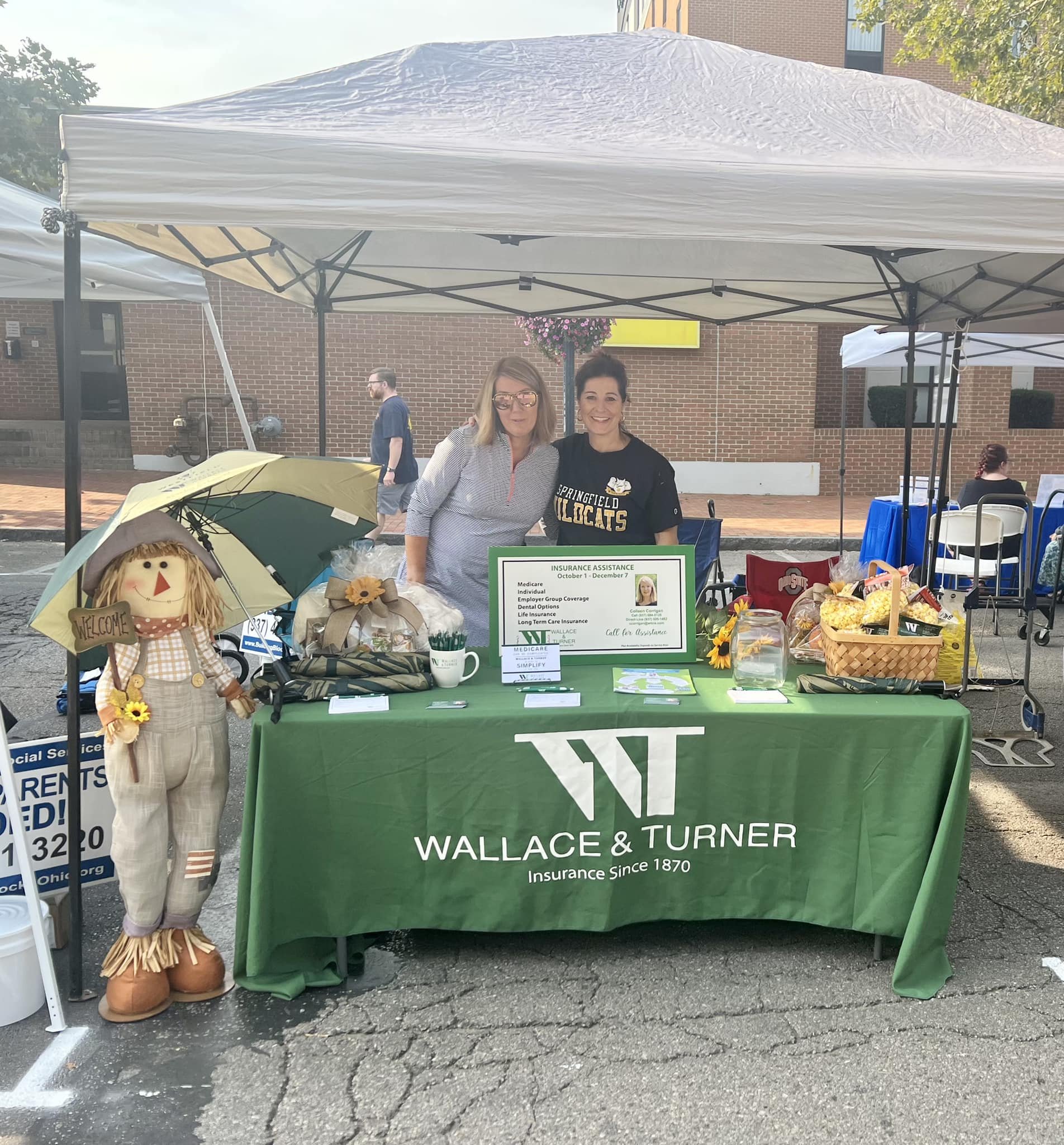

About Wallace & Turner

An independent insurance agency with offices in Springfield and Urbana, Wallace & Turner works with a range of top-rated carriers which means clients receive comprehensive and cost-effective insurance options tailored to their needs. The agency is a long-standing member of Associated Risk Managers International, Keystone Insurers Group, Trusted Choice, Ohio Insurance Agents Association and Independent Insurance Agents Association, both in Ohio and nationally. Connect with the agency on Facebook, Twitter and LinkedIn.