Spring is here and it's time to see how your roof weathered the winter. After sustaining months of low temperatures, snow, ice and harsh winds, it’s important to check your roof to prevent maintenance and liability issues down the road. Because spring is not without its own inclement weather, what started off as a minor issue could turn into major damage. Wind and hail are the most common causes of roof damage, affecting roughly 1 in 50 homeowners, with more than $10 billion in annual property loss, according to the Insurance Information Institute. Your home’s roof is the first line of defense against the elements, but if it’s not properly cared for, your homeowners insurance may not cover a loss.

Will Homeowners Insurance Pay for Roof Damage?

The dwelling coverage section of your homeowners insurance policy protects the structure of your home, including the roof, from perils such as wind, fire and hail damage. If your roof is damaged due to a hailstorm or heavy winds cause a tree to fall on your home, your dwelling coverage would cover the cost if you file a claim. If the damage occurs to an unattached structure on your property, such as a shed or detached garage, you may be covered by the “other structures protection.” Similarly, if the contents of your home or garage are damaged, “personal property coverage” would help to replace or repair them.

Keep in mind that you will need to pay your deductible before your homeowners insurance kicks in to pay for repairs and loss. It’s also important to note that some homeowners policies have windstorm and hail exclusions, meaning damage from either would not be covered. You may consider a separate deductible applied to your homeowners policy to cover wind and hail damage. Wind and hail deductibles are typically anywhere from 1-10% of your dwelling coverage amount. Understand what your coverage limits are and talk to your insurance agent to develop a policy that fits your needs.

Does Homeowners Insurance Cover Roof Leaks?

Homeowners insurance will pay for a roof leak if it is caused by a covered peril. Examples of common insured risks include falling trees and limbs, windstorm, hail, issues caused by snow, ice or sleet as well as vandalism.

A leak and resulting damage will not be covered due to lack of maintenance, or wear and tear. A home insurance policy isn’t meant to be a maintenance policy and an insurer will expect the homeowner to be responsible with upkeep and repairs. Homeowners insurance policy are designed to cover damage that is sudden and accidental, rather than damage that accumulated over a number of years, such as an aging roof or unresolved maintenance issues. For example, if you experience a severe thunderstorm and your roof begins leaking, if it’s determined that the roof had been rotting for some time without being repaired, your insurer could conclude the damage was gradual and deny your claim.

Common policy exclusions that could cause a roof leak include:

Neglect

Mold, fungus, or wet rot

Wear and tear, and deterioration

Settling, shrinking, bulging or expanding

Birds, vermin, rodents and insects

Coverage is also limited for roofs older than 20 years old. They are typically insured at their actual cash value, meaning you’re only reimbursed for the roof’s value after 20+ years of depreciation.

Your insurer may deny a homeowners claim for the above reasons, which is why it’s important to conduct regular roof inspections. If you’re planning to buy a home, be sure to learn the roof’s age and condition, and address any issues before the sale is complete.

Protecting Your Roof and Home

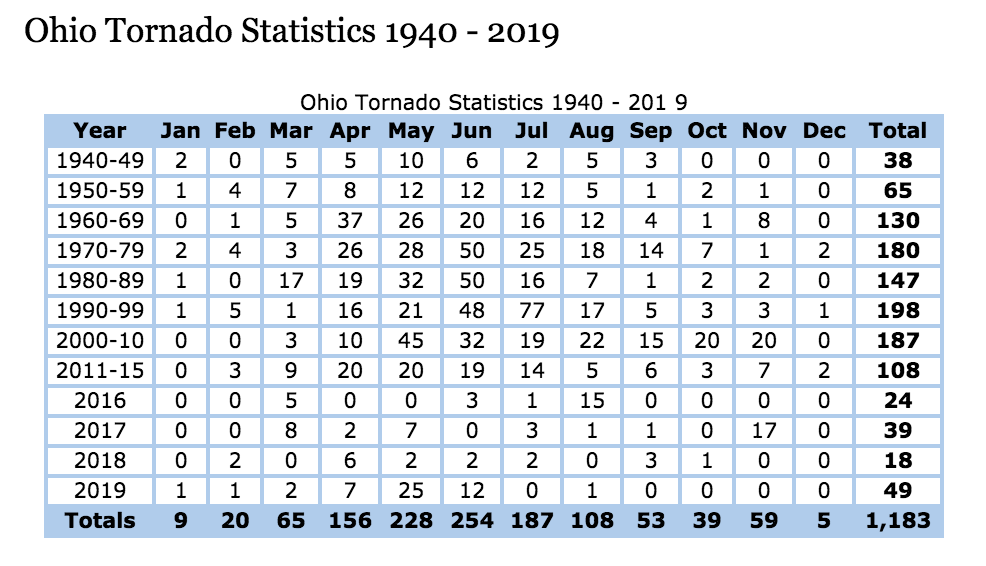

As your roof ages and is impacted by severe weather, its ability to protect lessens. Manufacturers provide an estimated lifetime rating for roof shingles, but that’s under ideal circumstances, not actual conditions that typically occur in Ohio, like snow, hail and thunderstorms.

Aside from weather, there are other factors that can affect the lifetime of a roof shingle:

improper installation

improper ventilation

slope of the roof

Here are six ways you can make sure your roof is in good shape and will protect your home:

Inspect your roof regularly so you can be on the lookout for early signs of failure. Check for loose, missing or curling shingles; growing moss or algae; waves or ridges in the roof line that can indicate problems with the roof decking or framing.

Clear any fallen branches or other debris, and don’t forget about gutters – built-up leaves and even animal nests should be removed.

Keep trees trimmed to avoid leaves, branches, pods from falling on the roof and clogging up gutters.

Check transition points in the roof for wear and tear. For example, where the roof meets the chimney or a skylight. This can easily create opportunities for water to enter the home.

If you notice any area of concern, contact a roofing contractor to inspect and make necessary repairs. It’s best to leave roof repairs to professionals to prevent a more serious issue that could result in an entire roof replacement.

Replace your roof when age or conditions indicate that it won’t be able to adequately protect your home. Replacing a roof can be expensive but it may be your only option if you want to avoid larger, and potentially even costlier repairs. Let your insurance agent know when you replace the roof so you can insure your home for the proper value.

Filing a Roof Replacement Claim

If your roof is damaged after a storm or other covered peril, here are steps to file a claim:

Take photos of the roof and damage.

Hire a contractor to make immediate repairs to prevent further damage to your roof and the inside of your home.

Contact your insurance company to determine if the roof damage is covered.

File an insurance claim with your insurer.

Schedule an appointment with for your insurance company to inspect the damage.

Questions about roof damage or filing a homeowners claim? Contact Wallace & Turner at (937) 324-8492 in Springfield, (937) 652-8492 in Urbana, or info@wtins.com.